In today’s 1-minute case study, we’re going to take a look at how we can “crash test” a retirement plan menu using the Portfolio Crash Test tool. Users of our 401kFiduciaryOptimizer will already have access to over 85k retirement plans across the country and can optimize their assets for lower cost alternatives, but using the Portfolio Crash Test we can take it one step further.

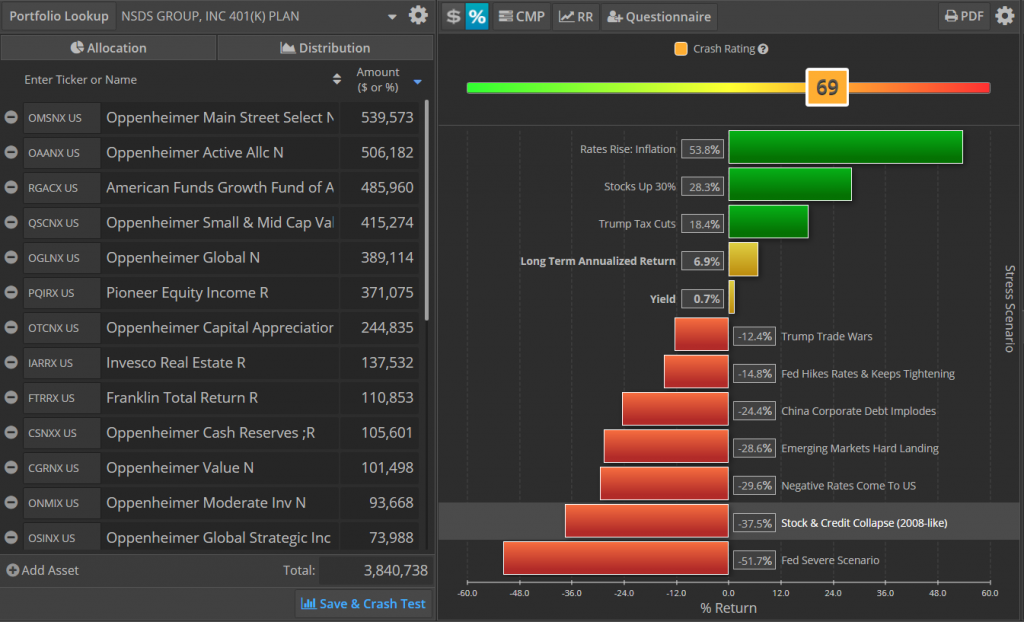

Using the Portfolio Crash Test, we are going to stress-test the funds and current allocations of a plan. For our example we are looking at NSDS GROUP, INC 401(K) PLAN.

In this plan, we can see it’s been rated as a 69 Crash Rating (What you need to know about the Crash Rating in Portfolio Crash Testing). For reference, the S&P 500 Index has a Crash Rating of 72. So the current riskiness of this plan is very close to the stock market in general. So right away, we can see that participants of this plan may not be taking advantage of some of the safer options available to them in their portfolio.

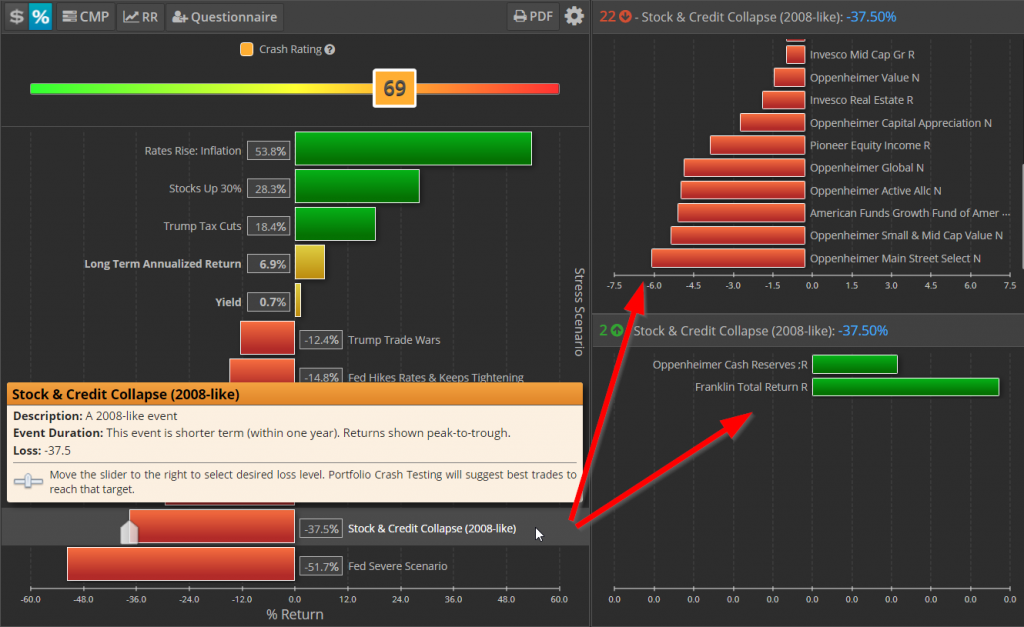

Looking at our “Stock & Credit Collapse (2008-like)” scenario, we can see that this plan stands to lose 37.5% of their assets if another 2008-like market correction occurred. Going further, the Portfolio Crash Test also shows us specifically which funds in this plan are contributing to this loss.

On the right side of the screen, we can see there are several funds causing a large amount of loss on this plan in a 2008-like scenario, the two largest contributors being the Oppenheimer Main Street Fund and Oppenheimer Small & Mid Cap Value fund. Below that, we can also see that there are two positive contributors in this scenario as well (Oppenheimer Cash Reserves & Franklin Total Return). This tells us that plan participants may be potentially over-exposed to some of the riskier equity funds in their plan, and if this is more loss than they can tolerate, they may want to start investing more into some safer funds.

Using the Portfolio Crash Test to manage a retirement plan’s risk a great way to keep plan sponsors and participants educated on how to manage their fund selection in their 401k so they can be sure to take advantage of the safer options available to them in them if needed.

See our other case studies: