For this week’s Larkspur-RiXtrema case study, we’re going to take a look at the Summary report of a random plan and we’ll try to optimize it in terms of performance, and cost-efficiency. As you already know the 401kFiduciaryOptimizer algorithm automatically provides you with cheaper but highly similar funds, but have you ever thought about improving the performance of the alternative plan?

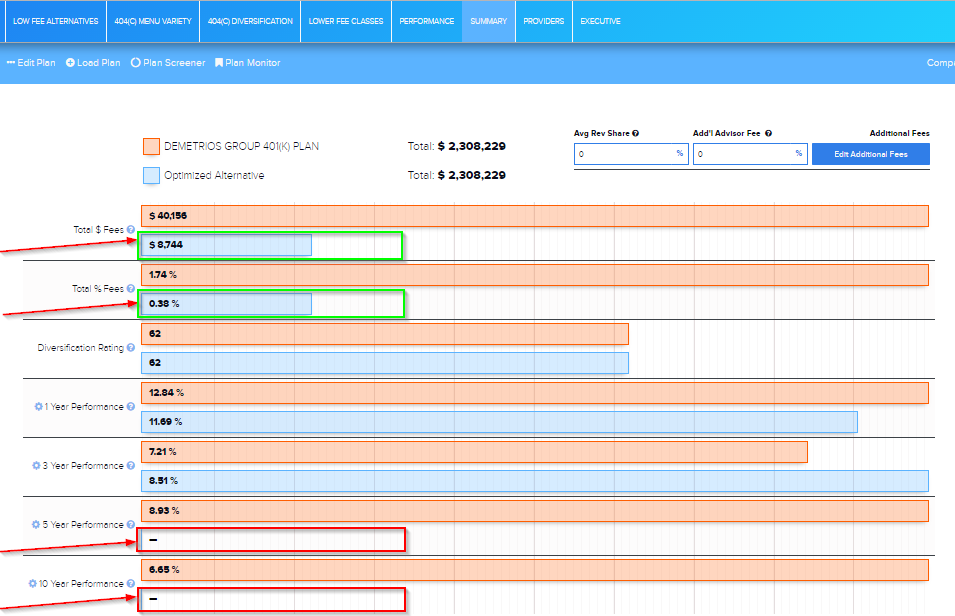

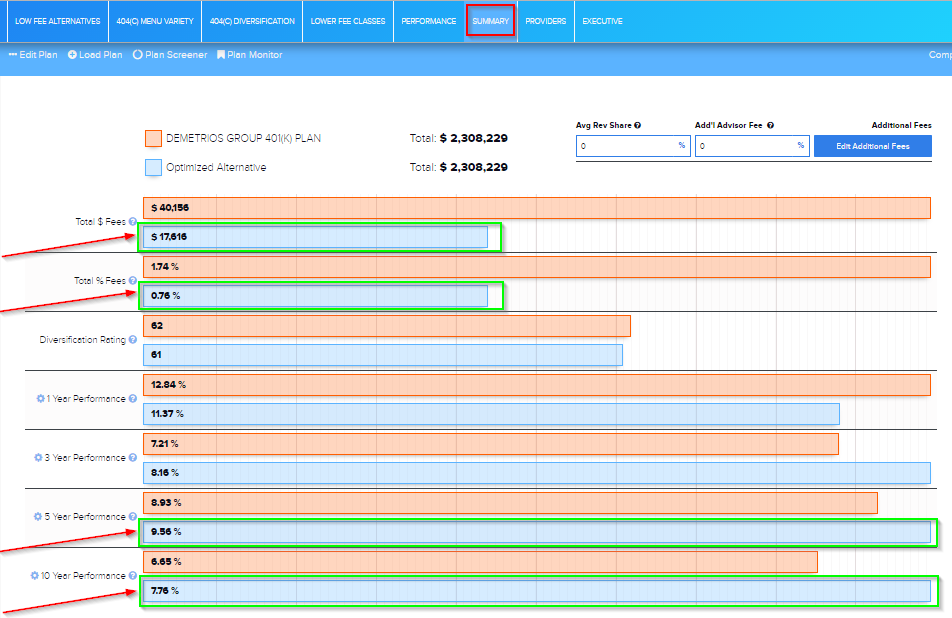

Let’s take a look at DEMETROS GROUP 401(K) PLAN Summary Report:

As you can see, the fees are significantly lower for the provided plan menu, but it still lacks a 5 and 10 year history.

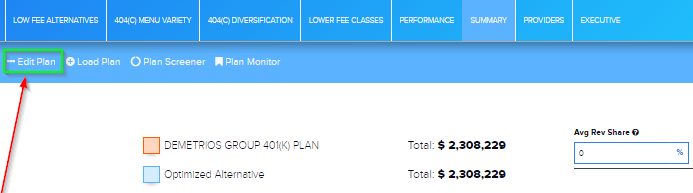

To fix that, let’s go to the Edit Plan section and customize our settings:

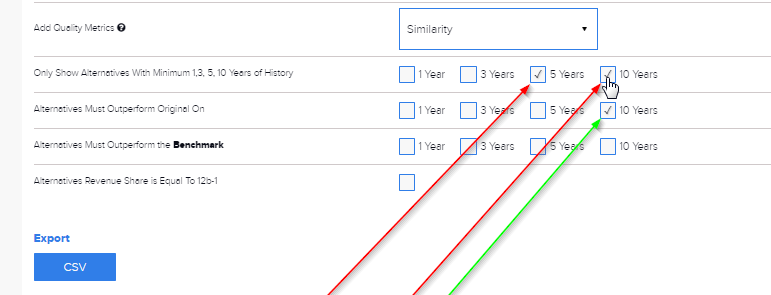

At the bottom of the page we will place a check in the following boxes:

- 5 and 10 years in the setting called Only Show Alternative with Minimum 1, 3, 5, 10 Years of History

- 10 years in the setting called Alternatives Must Outperform Original On

Now, let’s go back to the Summary report and…here you go!

Through a simple settings configuration in the Edit Plan section we now have the best balance between cost efficiency and performance! At this point nobody could argue against the fact that the initial plan needs to be optimized.

See our other case studies or schedule your personalized tour of 401KFiduciaryOptimizer today:

Pingback : Your 1 minute case study on 401K Retirement Plans: Crash Testing a 401(k) Plan