- There’s never been a better time to adopt advising technology.

- The biggest challenges for advisors in the next five years

- Investors want anywhere access and personalization.

- Technology: The solution and the problem

- Opens new Distribution Channels to Grow Business:

- Risk Mitigation

As I wrote before, the Coronavirus lockdown was a beta test for remote work, but it doesn’t seem to be going anywhere anytime soon. The question falls to all of us:

“Am I measuring up to my competition and adapting to the new environment?”

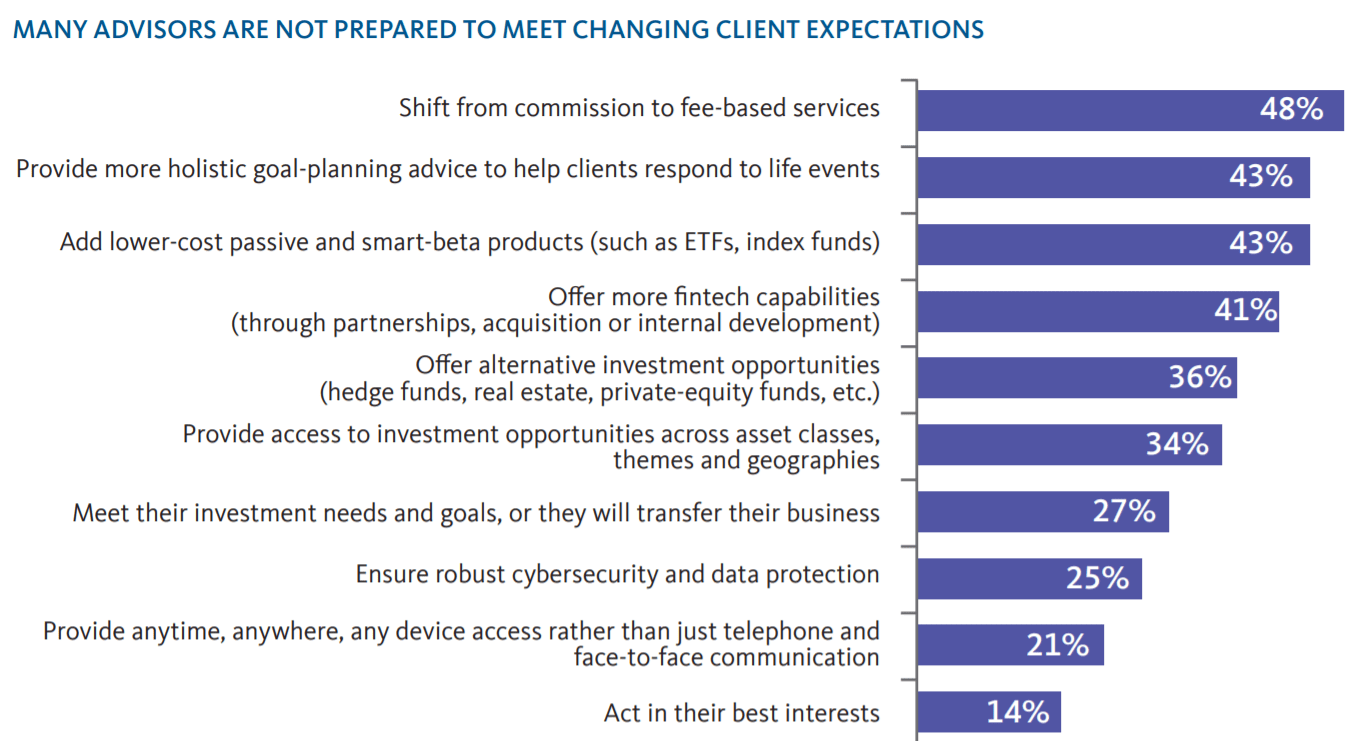

Advisors don’t have to look far to learn where the industry is going. Before the lockdown forced all of us to see the potential in working remotely, Broadridge reached some startling conclusions about technology use by financial advisors. They surveyed 1,500 investment providers, including 250 wealth advisors, to find, in general, that they are not taking advantage of the benefits and high ROI of technological adoption.

This article is an industry review and contains some key insights about the financial services industry you won’t want to miss.

There’s never been a better time to adopt advising technology.

Has the coronavirus and market volatility caused tension between you and your clients? During any market downturn, many financial advisors struggle to assure their portfolio clients that they are in good hands, even with a steep portfolio decline in March.

Let’s face it. Millennials and Gen Z will replace your wealth portfolio clients of today. That’s the idea, anyway. Also, 401(k) plan sponsors will be under younger leadership eventually. So, it is essential to know how their preferences are different from your current clients.

Robo options and passive investment services are becoming more and more attractive to these younger leaders. Millennials, for instance, are just starting to seek financial advising services and could be lifelong clients unless pulled into a DIY or Robo investment alternative. If advisors don’t meet these shifting investor expectations, they risk losing out to lower-cost robot and passive investment services.

Figure 1: Percentage of advisors unprepared to meet client expectations

The biggest challenges for advisors in the next five years

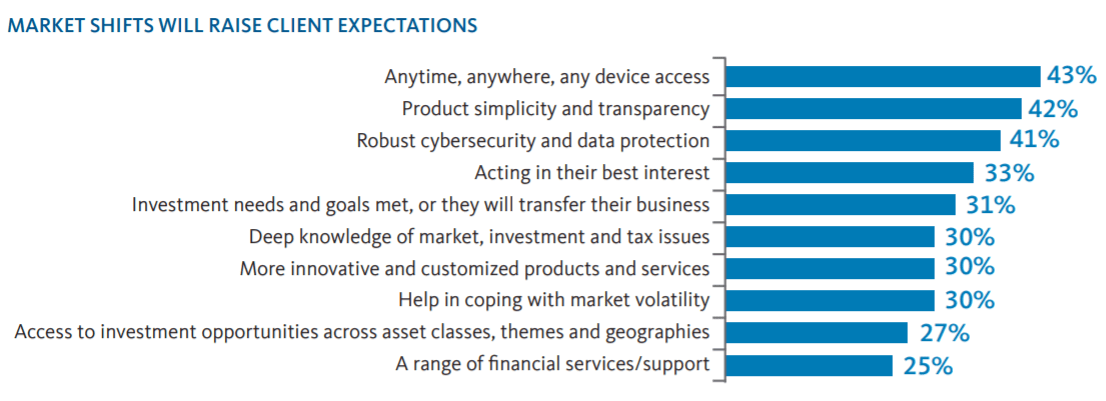

Keep in mind that this survey of 1500 investment professionals took place well before a pandemic reframed our focus. Yet, still, 43% of advisors knew that they needed to provide services “anytime, anywhere, across any device.” Frankly, now you’d be hard-pressed to find an advisor who would disagree with that market expectation.

Figure 2: The most significant changes Investment advisors anticipate in the next five years

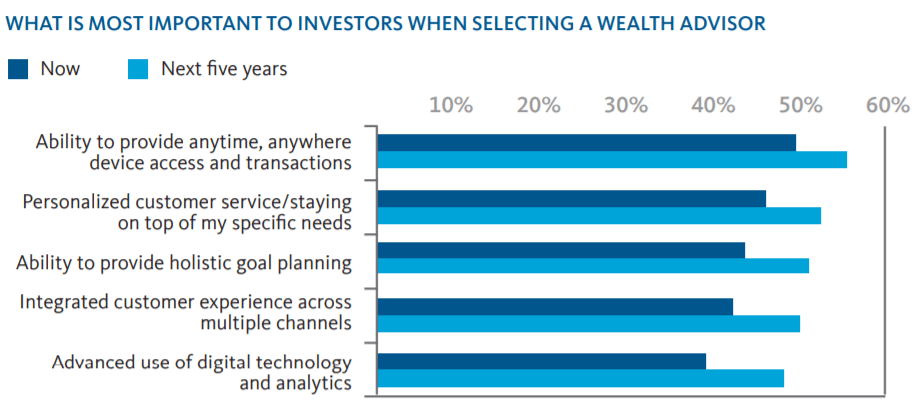

Investors want anywhere access and personalization.

Just as the surveyed advisors predicted, 50% of investors cite access and personalization to be essential when selecting a wealth advisor (Figure 3). What is even more intriguing is how many expect

The preference for technology now and in the future means that many will be switching their wealth advisor if they do not see them moving into the 21st Century.

Figure 3: Percentage of investors citing each attribute as highly important when selecting a wealth advisor

Technology: The solution and the problem

For wealth advisors, technology is both the market disruptor and a panacea to keep clients longer and happier. While technology creates frictionless alternatives to human advisors, it is still enabling financial advisors to grow their business and serve more clients by streamlining their processes.

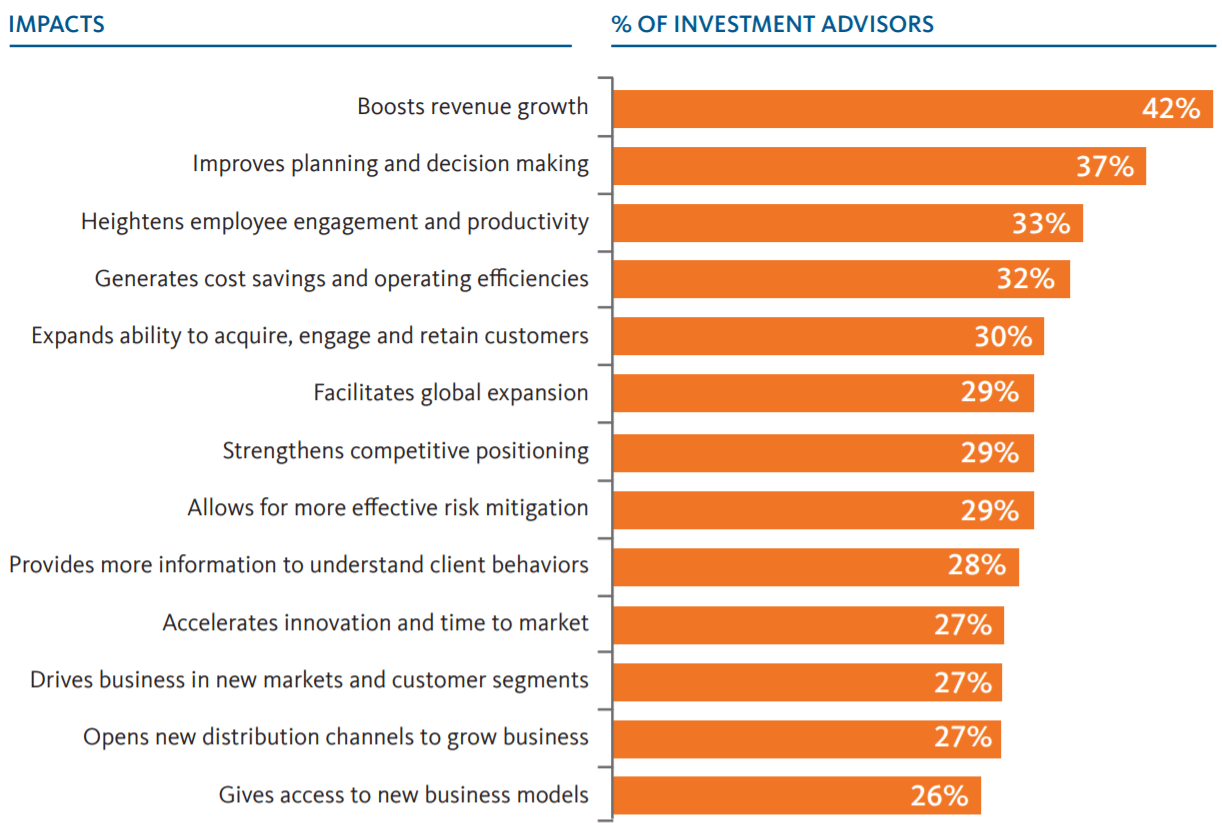

Figure 4: Positive impacts investment advisors are seeing from technology now

Less than half of advisors use digital tools to support most investor activities. While that number is growing, no financial advisor wants to be behind in the pack and playing catch-up on the latest technology developments.

RiXtrema’s software suite provides RIAs with opportunities for revenue growth while economizing their time and streamlining business processes like compliance.

Opens new Distribution Channels to Grow Business:

Larkspur Executive provides marketing capabilities to target any of the 700 thousand 401k plan sponsors in its database. It comes with built-in marketing email templates and automated campaigns to convert leads into clients.

Risk Mitigation

Portfolio Crash Test Pro helps RIAs present risk assessments and analysis to build trustworthy relationships with clients. Containing hundreds of risk scenarios and a built-in Risk Capacity Questionnaire, it integrates with Wealthbox and other CRMs to streamline business processes.

A 21st Century Advisor deploys technology tactfully to grow their business sustainably. RiXtrema strives to do that every day by tailoring our software suite to our clients’ direct needs based on real-time feedback.

In the 21st Century, information is vital. So, click the banner below to receive a short demonstration of Portfolio Crash Test Pro or any of RiXtrema’s financial planning software. You’ll be glad you did.