Case Study: Diversifying 401(k) Plans as a Great Prospecting Opportunity

The Ask: Creating a great proposal that will increase interest from your prospects should be ideal not only in terms of cost-efficiency but also in terms of diversification. While cost-efficiency...Read More

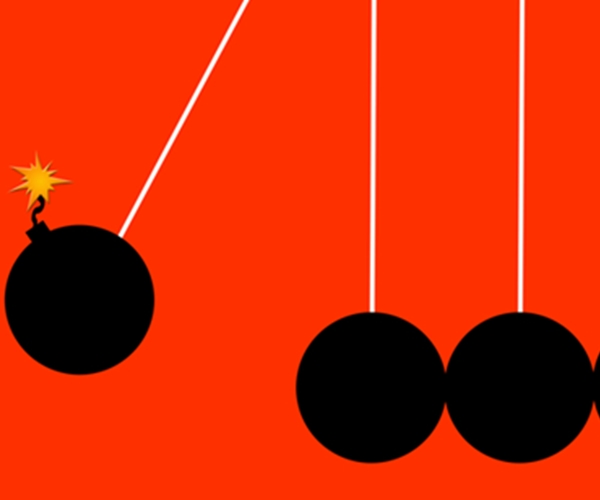

Case Study: What will Happen to my Client’s Portfolio if the Chinese Credit Market were to Explode?

The Ask: It is a fiduciary duty of each advisor to protect investments of a client. How can it be done effectively before a disaster strikes? It is customary to...Read More

Case Study: Growing Your 401k Business with the Right Prospecting Strategy

Every advisor is constantly thinking about ways to grow their business. There are many options available to achieve this goal. However, there is no cookie-cutter formula on how to make prospecting a successful endeavor.

Case Study: Create the Ultimate Optimization Report for a Plan Sponsor

In order to create a winning proposal for a prospect, you need to make sure it includes all the best investment options. On the one hand, they should be optimized in terms of fees and performance, which might interest a plan sponsor, and finally they should correspond your provider platform requirements.

Case Study: How to Identify High Net Worth Leads in Your Area

Our client has a broad list of potential prospects available to search from through our Prospects of Wealth 2.0 database, but they want to be able to narrow down this massive list into a more refined list. For example, they specifically may want to offer their services to prospects with a large amount of savings that are approaching retirement soon.

Case Study: Identifying Fiduciary Risks with the Right Tools

Our client is able to review and analyze virtually every defined contribution plan in the country using the Larkspur Executive. They specialize in acting as a fiduciary to the plan and helping plan sponsors to avoid fiduciary liability themselves. When hunting for new prospects they need a variety of specialized indicators can tell them if a plan may be at fiduciary risk so they can market their services to these prospects.