Revenue-Sharing Conflicts

Reg-BI represents a significant change in the SEC’s regulation target. Revenue Sharing is the practice of an investment fund security sharing money back with broker-dealers who sell it to clients and it was not regulated by the SEC prior to Reg-BI. By Reg-BI’s new standards, it exposes BDs to Best Interest violations.

Specifically, the conflict of interest obligation eliminates many of the traditional means of disguising BDs may be forced to change or explicitly acknowledge revenue sharing arrangements to mitigate Reg-BI.

Reg-BI may force revenue-sharing to change for BDs.

- Brokers can no longer just follow FINRA’s suitability standard because it did not impose many restrictions on revenue sharing.

- Reg-BI strengthens the standard of conduct for brokers and the fees they can collect

Not all revenue-sharing payments create problems, but brokers should be wary of 3 categories of payment-related conflicts:

1.Payments based on sales or assets:

- The SEC prohibits sales quotas and bonuses tied to product sales

- These conflicts need to be eliminated because mitigation seems to be impossible to justify.

2.Payments for services:

- Platform or access fees act similarly to distribution fees paid as part of an expense ratio.

- Education, training, and conference expenses to teach brokers about products may not cause conflict unless it is viewed as a reward.

- Training and education could cause a subconscious bias as BDs tend to recommend products they are more knowledgeable about.

- The SEC’s response to these payments will vary based on facts and circumstances.

3.Payments for recommended or preferred funds:

- Those paid for by asset managers or part of Robo-platforms

- These funds will create a conflict if the payment translates into a higher likelihood of recommendation despite the client’s needs.

It can not be stated enough – the conditions and circumstances surrounding the facts of each payment and recommendation will affect whether the SEC considers it a violation of the Reg-BI obligations. Fund expenses are a critical but only one consideration of a best-interest recommendation. Simply recommending the lowest-cost security or investment strategy does not necessarily satisfy the Care Obligation.

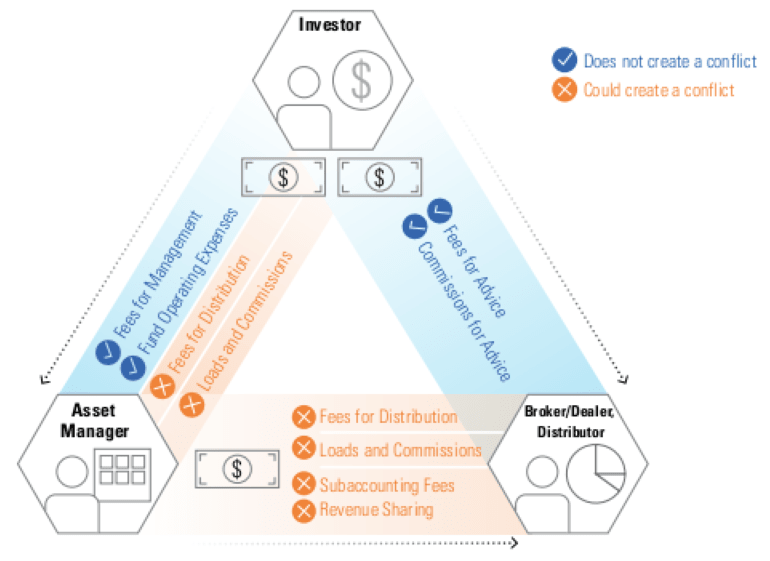

Figure 1 illustrates common expenses investors pay for mutual funds and advises which payments may create a conflict of interest (Morningstar). Figure 2 shows the common types of revenue-sharing arrangements and the conflicts they can present (Morningstar). Since violations will vary case-by-case, BDS need to tread carefully and conduct a thorough review of their product and services list for conscious and unconscious conflicts of interest.

As you can see, there is some nuance to the Reg-BI Changes. Please contact our Client Success Team with any questions or concerns about Reg-BI at clientsuccess@rixtrema.com. You can also read more about Reg-BI on our blog and learn about our Financial Planning Software Platform.