Late last summer, the U.S. District Court judge in the landmark 401(k) fee case, Tibble v. Edison, brought 10 years of legal wrangling to an end when he ruled in favor of the plaintiffs. The ruling in the Tibble case solidifies the requirement to monitor the investments offered in an ERISA plan, and in particular, the decision reaffirmed that plan participants should be offered the lowest cost share class available when prudent. Using the analytics in our 401KFiduciaryOptimizer, we have long known that the Edison plan was not unique in offering higher priced share classes when lower priced share classes are available.

With so many lawsuits claiming fiduciary breaches, we knew that Tibble would launch a new wave of litigation and we wanted to offer our clients better and more sophisticated tools to help the protect against becoming victims of such a suit. When the Tibble case was decided we immediately developed and launched a new tool within the 401KFO called Plan Monitor which allows plan fiduciaries to monitor plans they advise on a weekly basis to ensure that specific issues identified in Tibble can be immediately identified and acted upon. In particular, Plan Monitor highlights any lower cost share classes that become available. By monitoring plans weekly, fiduciaries are always aware of new developments in plans they advise on.

Given that backdrop, we were not surprised to read the news of Disselkamp v. Norton Healthcare. This new lawsuit specifically focuses on the duty of plan fiduciaries to offer the lowest cost fee classes available. The plaintiffs claim that the participants overpaid about $2m in fees and lost $500k in performance gains over a 6-year period by investing in share classes that were higher cost than necessary.

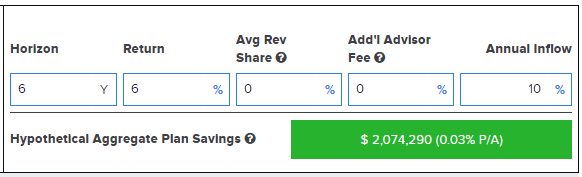

When I read about this lawsuit, I launched the 401KFO and found the Norton Healthcare plan to see what I could find. The plan had almost $669M assets with more than 13700 participants as of December 2016. The $2M in alleged excess fees over a 6-year period works out to be about 3bps per annum. This is very close to what I see in the 401KFO “Lower Fee Classes” report when I look over the same horizon and assume 6% fund returns and 10% inflows.

Contributing to the calculation of “Hypothetical Aggregate Plan Savings” are a total of 5 funds that have lower fee classes available that range from a high of 17bps per annum cheaper to 2bps per annum cheaper. It should be noted that the second largest allocation with $75M in participant assets is the fund with the largest 17bps differential in fee classes. Switching this fund alone to the lower cost share class would save participants more than $1.2M under these assumptions.

What I found interesting in examining this plan, is that there appear to be many other issues with this plan, that if corrected could save participants far more than 3bps per annum. But these issues are likely harder to litigate, and the Tibble case has made the decision not to offer the lowest cost share classes to participants low hanging fruit for trial attorneys.

This research does not constitute legal advice and is for informational purposes only.