PCT Pro Using RetireRisk To Plan Cashflow In Retirement

PCT Pro was designed

Portfolio Crash Test Pro was created because there was not a tool for Financial Advisors that allowed them to specifically examine the internal and external risk of a client’s portfolio. Each feature within the software enables a financial advisor to confidently sit with a client and explain the opportunities and vulnerabilities of their investment situation. RetireRisk, one tool, aims to contextualize the client’s portfolio around their retirement plans.

PCT Pro’s tools are best used in harmony

There are many features in PCT Pro that help financial advisors better understand their client’s financial situation. Indeed, RetireRisk is best when combined with an assessment of Risk Tolerance and Risk Capacity with the questionnaire which can complete at home before a meeting. The questionnaire assesses the emotional and practical capacity of a client to bear risk in search of a reward. Advisors tell us that clients appreciate when many aspects of their personal situations are considered and RetireRisk is a real-time display of possible retirement.

Here’s how to use RetireRisk.

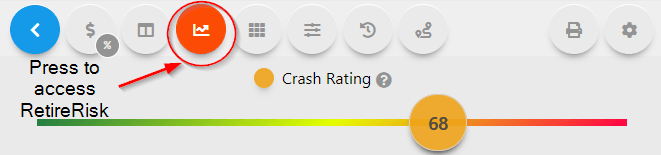

- The RetireRisk module is located directly above the Crash Rating and Risk Capacity slider. Click this to open the tool.

Figure 1: RetireRisk is found in PCT Pro above the Crash and Risk Capacity Ratings

Whereas some Retirement Planning Softwares bind options and limit customizability, PCT Pro allows you to personalize each model to match your client’s unique financial situation.

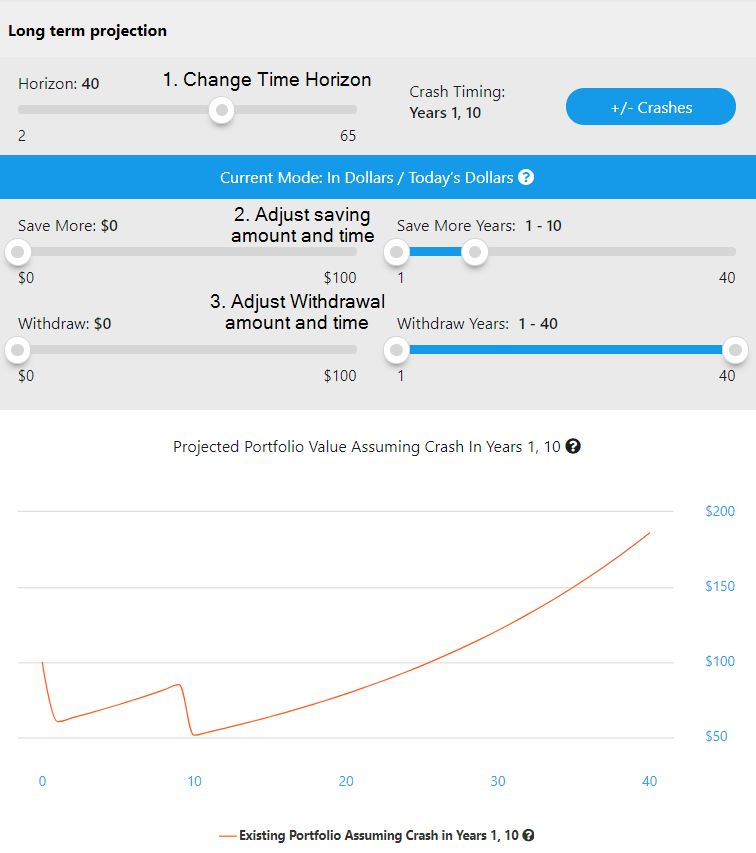

2. If necessary, adjust the time horizon; saving period and annual amount; then the withdrawal period and annual amount. This will create a chart reflecting the projected portfolio value.

Figure 2: RetireRisk presents cash flow estimation across time.

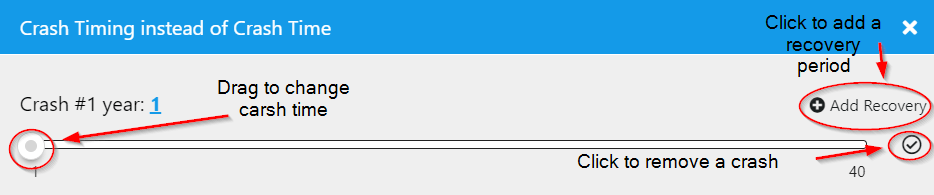

3.We recommend inserting a crash around every 15 years into a retirement model, so we made those the default parameters. This assumption is safe to assume based on historical recessions. The magnitude of a crash is not customizable, and RetireRisk uses the average loss of the worst 3 crashes in the default scenarios. However, you can add and remove crashes, or a recovery to cater to you or your client’s expectations. (At this time there is not a scenario to model a complete financial collapse, Mad Max scenario.)

Figure 3: Add crashes to simulate the business cycle

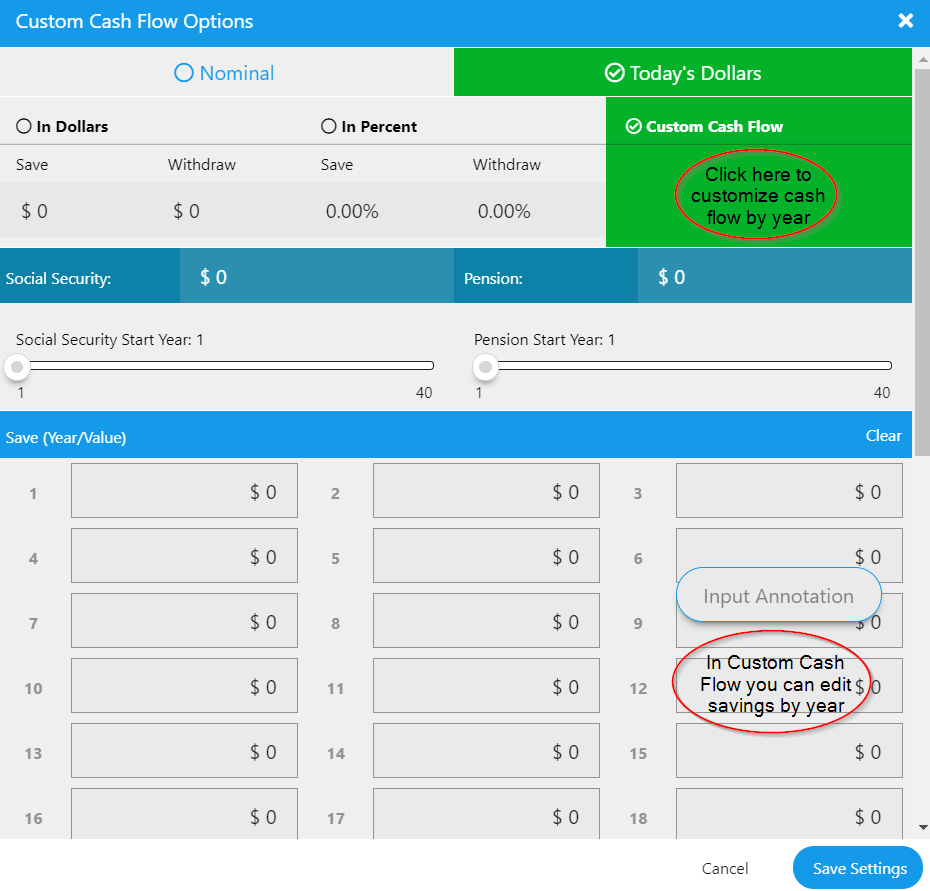

4.Whereas some retirement risk planners bind the possible outlooks, PCT Pro allows you to specify annual cash flow changes by year (Figure 4). You can build a trustworthy relationship with clients by presenting models catered to their unique situation. Maybe the client wants to give money to grandchildren in years 26-30, expects to save more after inheriting money from that creepy uncle, or expects a divorce soon after retirement. After discussing the client’s planning and expectations you can build that into PCT Pro’s retirement model. Also, you can express these values in nominal or real terms. Modeling in today’s dollars assumes a 2% loss in value due to price level increases.

Figure 4: Custom Cash Flow allows you to enter specific annual cash flow amounts.

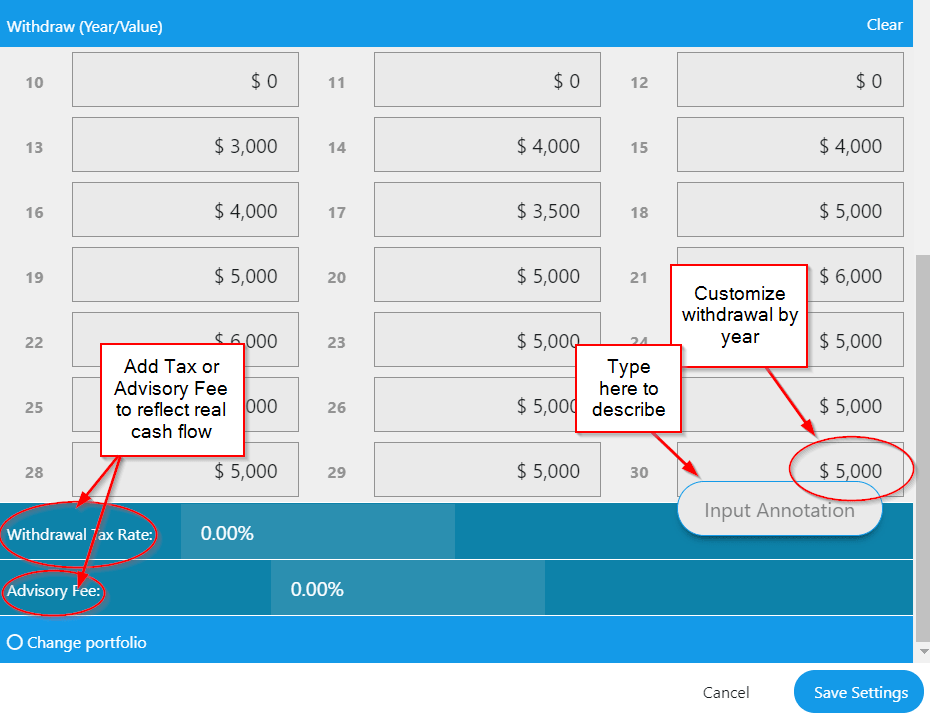

5.In this same window, you can also customize annual withdrawal rates and add annotations to describe a particular year (Figure 5). You can also add a withdrawal tax and advisory fee, though these elements are not customizable by year.

Figure 5: Customize annual withdrawals, tax rate, and add an advisory fee to give a real picture to the client.

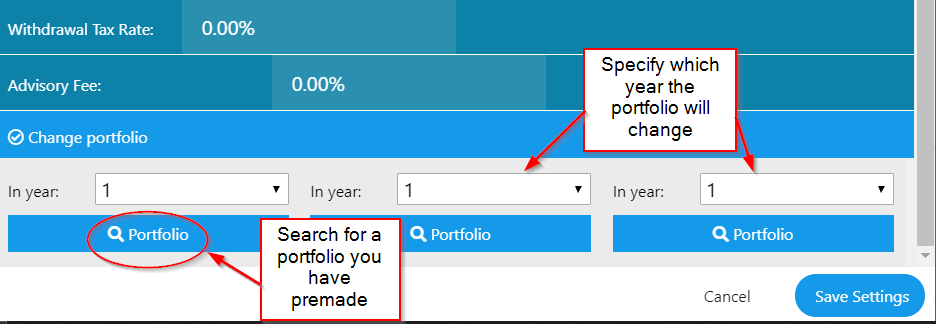

6.Finally, if you desire, three portfolios can be attached to a model (Figure 6). A retirement portfolio will not stay in the same strategy throughout the withdrawal period as the client’s Risk Capacity declines with age. This can be useful if the client anticipates switching to a different investment strategy as they age or have additional cash flow constraints. Simply click the bubble and load other premade PCT Pro portfolios.

Figure 3: Three portfolios can be added to a retirement model to show a model with various investment strategies.

As you can see, Portfolio Crash Test Pro allows you to better serve and communicate investment ideas with your clients with a simple interface, yearly customization, and tools to objectively measure a client’s financial position. The RetireRisk feature, though, is just one tool in the PCT Pro software. You can read more about PCT Pro’s tools at our blog where we also publish market commentary and economic analysis. Please do not hesitate to contact our client success team to learn more about Rixtrema’s financial planning software platform at clientsuccess@rixtrema.com.