- Crypto Investing

- A New Niche for Advisors

- Stages of this Niche Development

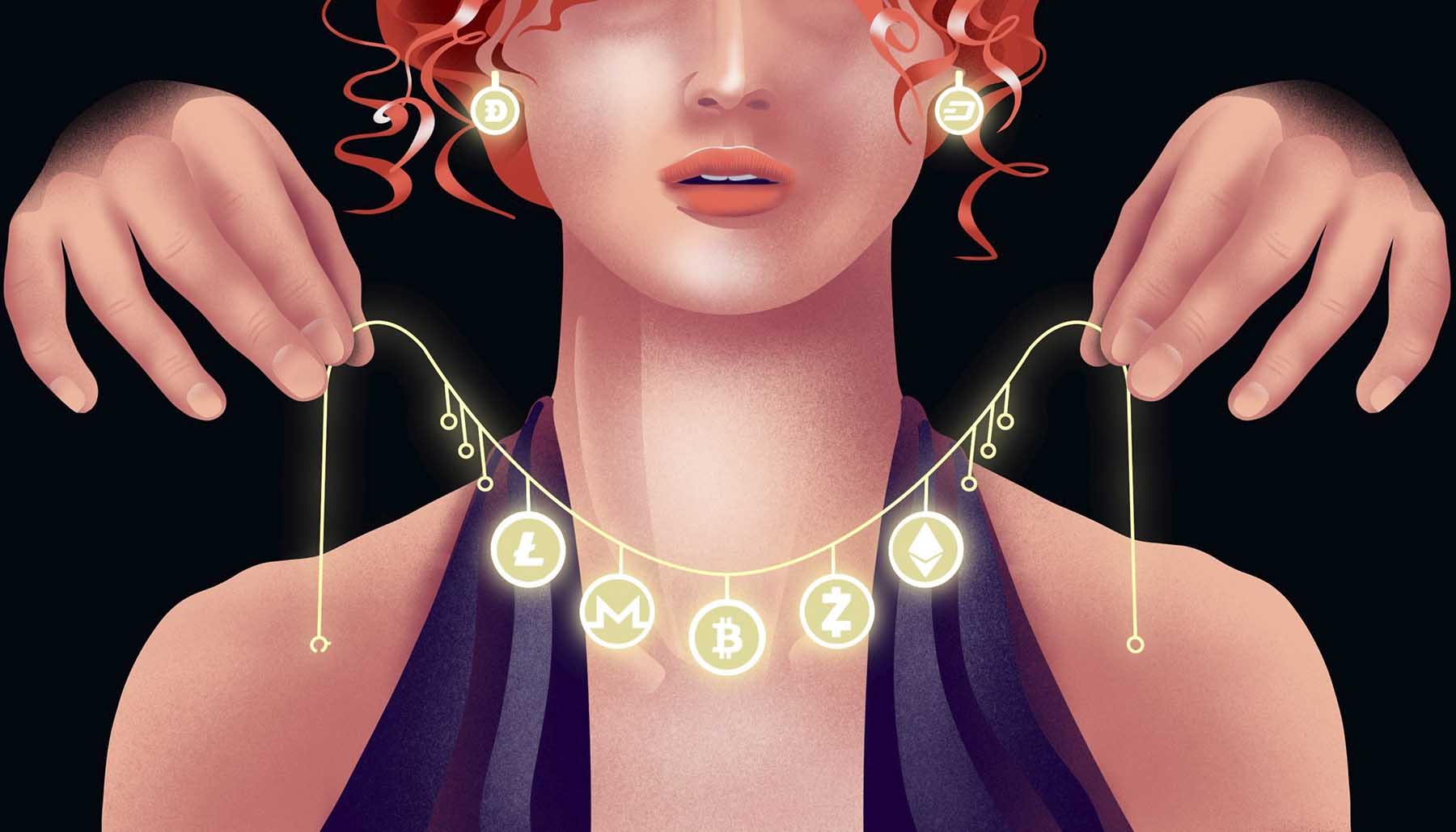

- Adding Crypto to Clients’ Portfolios

- The Future of Cryptocurrencies

Crypto Investing

Cryptocurrency continued to grow throughout 2021 and advisors need to prepare themselves and their clients for the year ahead. Thus, advisors must find new strategies for portfolio management and allocation. Advisors need to examine the pros and cons of a fed backed digital currency.

Another point of current interest is the question about the relations between cryptocurrencies and ESG investing: is crypto helping ESG investing or is crypto mining harming the environment? These questions remain unanswered for a large swathe of investors.

A New Niche for Advisors

At some point in their business, most advisors have been looking for some sort of specialization, some niche that would allow them to find their clientele and provide expert advice. For some advisors crypto has become this niche. They believe in a future that involves cryptocurrencies, in a big way. But at the same time, many clients did not feel at ease with crypto. So it was a perfect opportunity to jump in, become a specialist in this field and offer their clients advice and expertise.

That was the case with Steve Larsen, president of Columbia Advisory Partners in Spokane, Washington. As with so many financial advisory niches, Steve Larsen found his speciality right under his nose.

After buying his first Bitcoin back in 2015 for $235, Steve Larsen believes the digital currency is a real value now, at over $40,000. Six years after purchasing a single Bitcoin for $235 and then essentially forgetting about it, he stumbled on an article about cryptocurrencies.

Like many other advisors, Larsen also wanted to find a niche, but never really found one that suited him. Then, finally, he found it, one where people needed a lot of advice. And so, since March 2021 he’s been managing crypto portfolios for clients.

Larsen recalls being hungry for cryptocurrency knowledge back in 2015 when he made his initial investment. But he had difficulty finding information on areas related to blockchain and digital currencies, so he moved on.

Stages of this Niche Development

In 2021 there was a lot more information on the crypto market and advisors could quickly become fluent in cryptocurrency investing. Still, they respect the fact that it is still a foreign concept to many of their clients, which is why the initial move into the niche is often with the clients they already have really good relationships with.

Another stage of this niche development can include friends and family. After that, advisors start to expand it to the rest of the clients and to get new ones.

For most advisors who have chosen cryptocurrencies as their niche the main goal is for everybody interested in crypto to have an opportunity to invest, and also to provide education about what’s going on with cryptocurrencies so more people will want to go into it.

Adding Crypto to Clients’ Portfolios

When adding crypto to client portfolios, advisors usually build diversified allocations of several different cryptocurrencies that they monitor and rebalance just like a traditional portfolio.

Right now, crypto has to be considered the aggressive part of the portfolio, so advisors take it out of stocks. But at the same time, they’re also reducing exposure to cash and bonds to make room for crypto.

Even as crypto has become easier to purchase and hold, it still needs to find a place in a diversified portfolio, and the current uncertainty surrounding inflation is an open door of opportunity.

A large number of clients are nervous about the economy, inflation and the labor market, and they are open to systems that might help hedge the risk. Traditionally, that meant gold, real estate or starting your own business, but now crypto is believed to be the hedge.

In terms of challenges related to this niche, advisors are frustrated over the lack of regulatory clarity and the inability of regulators to draw a clear line. Most planners would like to see the SEC come in and add clarity, because the uncertainty is not helpful to anybody.

Another challenge is getting clients comfortable with the extreme price volatility of an asset class that can go up or down 12% to 15% a day, and up 300% or down 80% in a year.

The Future of Cryptocurrencies

Right now, the global financial system is built on global currencies, particularly the U.S. dollar, and that’s what crypto is looking to replace. The idea is that the dollar gets some well-needed competition to keep it in check.

Most advisors agree that the future of crypto in general and Bitcoin in particular is promising, they have not reached their tops yet and every client willing to diversify his portfolio can benefit from adding to it different cryptocurrencies.

To better adjust your client’s portfolio, use our Portfolio Crash Testing tool, a premier portfolio analytics and financial planning tool.

To analyze the coins and tokens and to evaluate the riskiness of digital assets, you can use our CoinOptimizer tool where you can find hundreds of coins that could be added for your analysis and comparison.

These tools can be useful for financial advisors to help their clients analyze their crypto investments and plan for the future. Please contact us at clientsuccess@rixtrema.com or dial (800) 282-4567 to request your personal online demo of the Portfolio Crash Testing, or the CoinOptimizer, or any other software from RiXtrema’s toolbox for growing your advisory and retirement plan business.