Your 1 minute case study on 401K Retirement Plans: Improving 404(c) Diversification

For this week’s Larkspur-RiXtrema case study, we’re going to take a look at a plan’s investment menu and how we can improve on it’s diversification to satisfy 404(c) requirements. By default, the 401kFiduciaryOptimizer will build a proposed plan menu of quantitatively similar funds that are low cost. However, using the 404(c) Diversification report, we can build a plan menu that is not only lower cost, but improves on the original plan’s diversification.

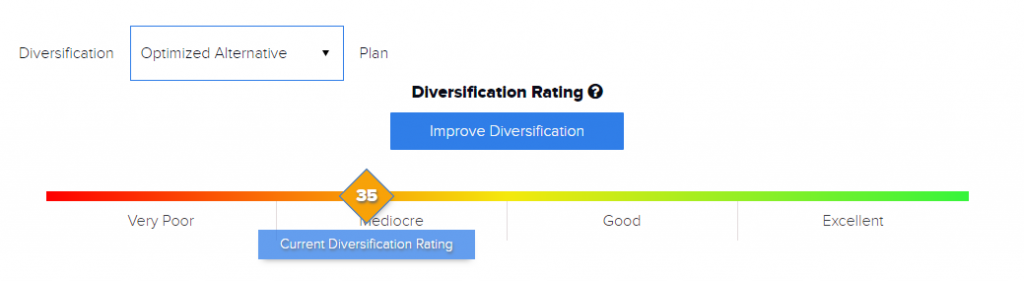

In our example, we are looking at a sample proposed plan for the BEHAVIORAL HEALTH GROUP EMPLOYEE 401(K) PLAN. Our starting point for diversification in this plan is a very low score of 35.

To improve the diversification for our proposed menu, all we need to do is press the “Improve Diversification” button to get started.

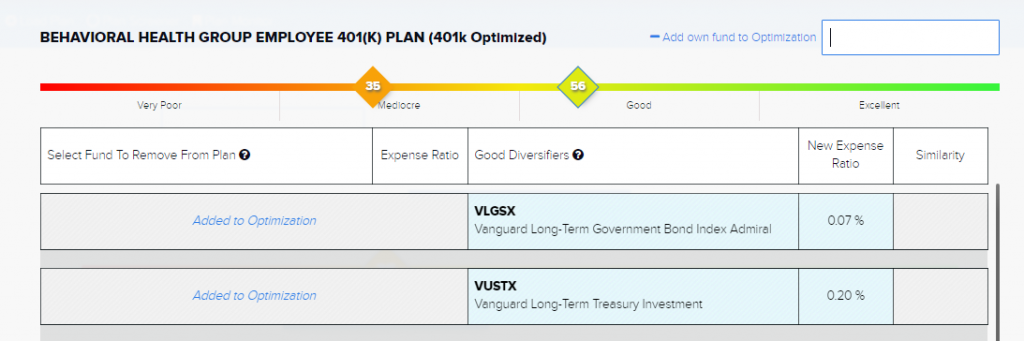

From this menu, we can see a list of funds in our proposed lineup that are the most positively correlated. This can give us some guidance for what to replace in our current menu. However, we are not just restricted to replacing funds, especially in the case of a smaller plan menu. In this case I have opted to not replace anything, but to add in two new funds to our proposed menu, VLGSX and VUSTX (a government bond index and long-term treasury fund respectively). After adding only two new funds to the menu, we can already see the diversification rating has taken a huge leap from 35 to 56! Now we have moved from the “Mediocre” range to the “Good” range on our scale just like that.

Using the 401kFiduciaryOptimizer you can see how simple it is to make suggested improvements to a plan to not only save them money, but also to help them avoid potential fiduciary liabilities down the road with a poorly diversified menu.

See our other case studies or schedule your personalized tour of 401KFiduciaryOptimizer today: