- Take the offensive during this financial downturn

- Plan Sponsors are under pressure from Participants

- Make your marketing seamless and automatic

- Set it and forget it

Take the offensive during this financial downturn

Now is not the time for financial advisors to sit on their heels and reverse marketing strategies. 401(k) participant employees are more focused on work during boom times. But, when the market turns South, they contact plan sponsors for an explanation. That is when plan sponsors look to new advisors.

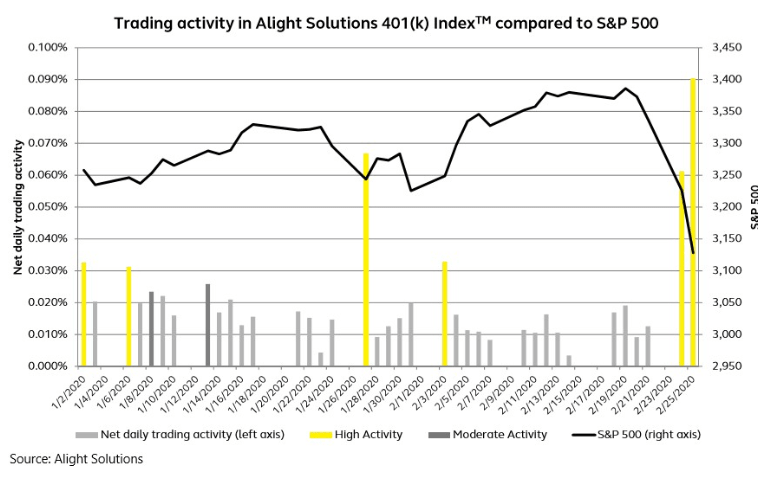

The initial S&P 500 declines associated with the Coronavirus Pandemic hurt 401(k)s. Badly. The crisis seemed to catch most long-term investors off-guard, and, now, retirement investors are shedding equity in favor of bond investments (Figure 1).

Plan Sponsors are under pressure from Participants

Plan Sponsors are beginning to be contacted by their 401(k) participants and need to have every detail and proper disclosure in order. That’s often not the case, though.

As Alex showed in his article, more Plan Sponsors are looking for fresh advice than ever. They are interested in changing management styles and integrating advising with employee financial education.

“But, Colin, I am not an advisor who offers financial education.” Well, you may have to be. More and more studies are showing that to be the new expectation. Employers are using 401(k) plans to attract top-tier talent, and smart employees will hold their managers accountable. Financial education is the best way to show that a plan is managed carefully and hears the concerns of the plan participants.

But, don’t worry. RiXtrema has some marketing tools that can strike the perfect balance between the quality and quantity of marketing content.

Make your marketing seamless and automatic

So, now is the time to be contacting Plan Sponsors with our straightforward marketing solutions. Larkspur Executive and 401(k) Fiduciary Optimizer easily prepare customized reports that highlight red flags and areas of mismanagement.

Larkspur Executive users always had the premier marketing solution for Financial Advisors, Customized Trackable Marketing Letters (Link). Now, Larkspur Executive Premium extends the software’s marketing potential.

The standard Larkspur Executive contains plan performance information on over 850,000 plans and holds the contact data of over 1.2 million plan executives.

The Pro version comes with everything in the standard software but with improved marketing capabilities. You can run automated email campaigns to 700k qualified plan sponsors and run 300 campaigns simultaneously.

Professional copywriters and marketing professionals design each email campaign. After analyzing the plan (Figure 1), you can choose a pre-made professional marketing template intended to highlight a plan’s shortcoming or regulatory error.

Best of all. You can set several emails into a delivery sequence so they unique templates automatically.

Set it and forget it.

When a decision-maker opens an email you will be notified.

Learn more about this new improvement on the landing page.

Contact our client success team at clientsuccess@rixtrema.com to learn more about any of RiXtrema’s financial planning, Reg-BI compliance, or risk software. Broker-Dealers and Financial Advisors need to keep in mind the June 30th Reg-BI compliance deadline. Just because the world seems to be on hold does not mean that RIAs or BDs can neglect marketing for new clients, remaining compliant with SEC regulations, or serving their clients.